On Monday, investors reportedly quickly pulled out of a variety of technology companies from Tokyo to New York as the supremacy of established AI giants like Nvidia was threatened by the introduction of a low-cost Chinese AI model.

Startup DeepSeek, which last week released a free AI assistant that claims to use less data at a fraction of the cost of incumbent services, raised concerns about the amount of investment required for AI.

Additionally, DeepSeek’s assistant has surpassed ChatGPT, a competitor in the US, in terms of downloads from the Apple app store by Monday.

The Nasdaq opened down almost 3% as a result of the news. The leading AI chipmaker Nvidia was the index’s largest drag, down more than 15%.

The tech-heavy index has since reduced losses, although it was still down 2.9% at midday.

Chip manufacturer Broadcom Inc. was the second largest drag on the Nasdaq, falling 15%, followed by Microsoft, which sank 3.7%, and Alphabet, the parent company of Google, which fell 2.7%.

With a 7.9% decline, the Philadelphia semiconductor index saw its largest percentage decline since March 2020.

Their drops came after a sell-off that began in Asia, where SoftBank Group of Japan ended the day down 8.3%, and spread to Europe, where ASML plummeted 7.6%.

Over the past 18 months, investors have poured money into the equity markets because to the hype around artificial intelligence (AI).

This has caused stock markets to soar to new heights and corporate valuations to soar.

Following President Donald Trump’s announcement of a private-sector plan for what he claimed would be a $500 billion investment in AI infrastructure through a joint venture called Stargate, U.S. stocks tied to AI saw a surge on Wednesday.

SoftBank, whose shares fell 7.8% on Monday, has since pledged $19 billion to assist in funding the Stargate joint venture with businesses including OpenAI and Oracle.

Shares of ASML, which is owned by Samsung, Intel, and Taiwan’s TSMC, fell more than 6% on the U.S. market. Siemens Energy, a European energy technology firm, saw a 19% decline.

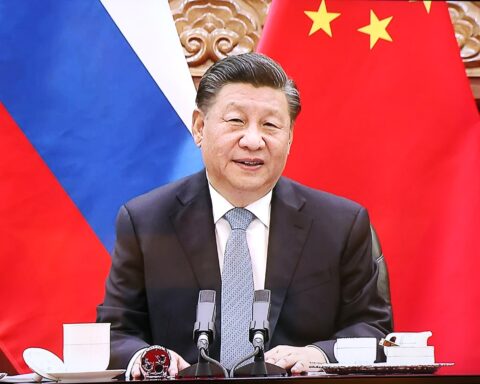

Not much is known about DeepSeek’s modest Hangzhou startup. In a study published last month, its researchers stated that the DeepSeek-V3 model, which was released on January 10, was trained using Nvidia’s H800 CPUs for less than $6 million, the amount that Pictet’s Withaar cites.

The H800 chips are not the best. They were first created as a reduced-capability product to circumvent restrictions on sales to China, but U.S. sanctions later made them illegal.

[READ MORE: CIA Now Favors Lab Leak Theory for Covid Origin]